Best Refinance Deals Fundamentals Explained

Wiki Article

Excitement About Best Refinance Deals

Table of ContentsThe Ultimate Guide To Mortgage Refinance DealSome Known Details About Best Refinance Offers How Best Refinance Offers can Save You Time, Stress, and Money.The Main Principles Of Mortgage Refinance Deal

As a debtor, you can possibly save thousands of bucks over the regard to your car loan when you lock in a reduced rates of interest (refinance deals). And oftentimes, a lower rates of interest also suggests a lower regular monthly mortgage repayment. This passion savings can enable you to settle various other high-interest financial debt, contribute to your interest-bearing account or place even more bucks towards retirement

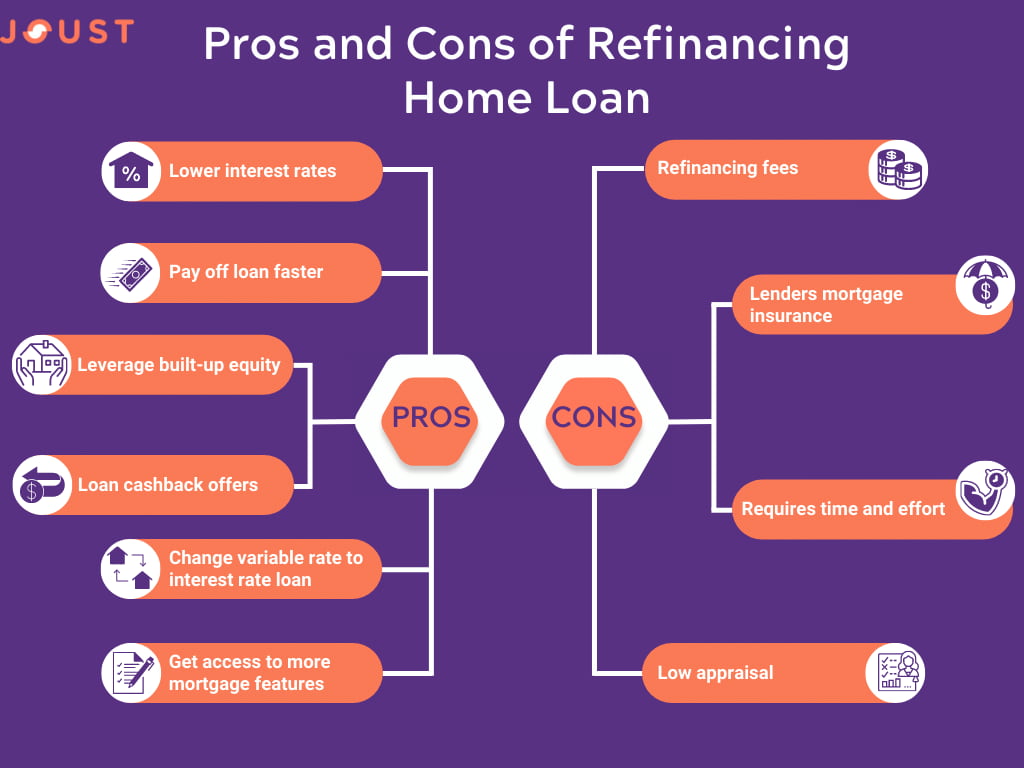

Refinancing your mortgage may appear like a challenging possibility, however doing so can save you thousands on your home car loan. Like anything, it does not come without its threats, so take a look at our benefits and drawbacks listing to see if it may work for you. One of the greatest advantages of refinancing is to make use of a reduced rate of interest.

You might utilize this cash on important or non-essential products, or remain to pay at the level of your previous payments and repay your funding quicker, conserving you on interest. Refinancing your home funding means you may have the alternative to reduce the size of the lending. Bear in mind this will most likely boost your month-to-month payments, however if you're in a position to do so, paying your funding off quicker is most likely to conserve you on passion over the life of the lending.

Unknown Facts About Mortgage Refinance Deal

Your regular monthly repayments will certainly increase but you will likely save thousands on interest. See to it you do the mathematics to see just how much you would certainly minimize rate of interest to guarantee this method works for you. Home equity describes the difference in what you have actually settled on your car loan and the value of your home.When you refinance your home your lending institution might enable you to access some or all of this equity, which you can use however you want. Keep in mind your equity is an effective tool in discussing with your lender, and can assist you to gain access to a much better passion rate.

A revise center permits you to make additional payments on your lending and revise these if needed, at the discretion of the lender. An offset account is an excellent way to lower rate of interest on the financing, while a revise center can be helpful in an emergency or if you need to make a large acquisition.

Top Guidelines Of Best Refinance Offers

If you're presently on a variable price finance refinancing means you might have the ability to switch to a set rate, and vice versa. With rate of interest at all-time low for a number of years, you may make a decision fixing your funding is the method to head to provide you capital assurance. Or, you may think rates of interest might go lower, so you intend to change to a variable rate and have some flexibility.In the present setting, no property owner can afford to simply think their lending offers excellent value. If you've had your finance for a couple of years, opportunities are, there could be scope for you to conserve. By protecting a cheaper rates of interest and lowering your regular monthly payment, you might be entitled to even more financial savings than you realise.

It deserves knowing it doesn't have to take 25 or thirty years to pay off a home. Below are some leading suggestions you'll desire to review that can simply help you Refinancing is commonly used to release up the equity you have in your existing home in order to money acquisitions or way of life objectives.

How much equity you can make use of will certainly vary in between lending institutions, which is why having a home lending expert on your side could make all the difference when it involves doing the research. Find out more refinance deals concerning accessing your home's equity..

The Ultimate Guide To Best Home Loan Refinance Offers

Australian passion rates get on the increase. The cash money rate (established by the Get Financial institution) has actually currently reached a seven-year high. Many formerly comfortable property owners may be really feeling the pinch as lending institutions travel through that cash money rate in the form of greater rate of interest. In plain terms, higher passion prices can mean higher settlements.

With rate of interest increasing, there's never been a far better time for Australians to make the button to a home mortgage with a better rate of interest price, or make the transfer to a brand-new service provider with fewer charges. You can re-finance your home mortgage with your current financial institution, a new lending institution, or even a home loan broker.

A lower rates of interest might conserve you countless dollars over the lifetime of the car loan. Switching to a home lending with a reduced rate of interest can likewise potentially aid you pay off your home loan quicker. If you get a far better rates of interest and remain to make the exact same settlements as you did on your old lending, you'll reduce the term of your lending.

Report this wiki page